Marketing is an essential part of any business, but can the costs associated with it be capitalized? The answer is not always straightforward, as it depends on the nature of the marketing expenses and the accounting standards in place. In this guide, we’ll explore the rules and regulations surrounding the capitalization of marketing costs, and help you understand how to properly account for these expenses in your business.

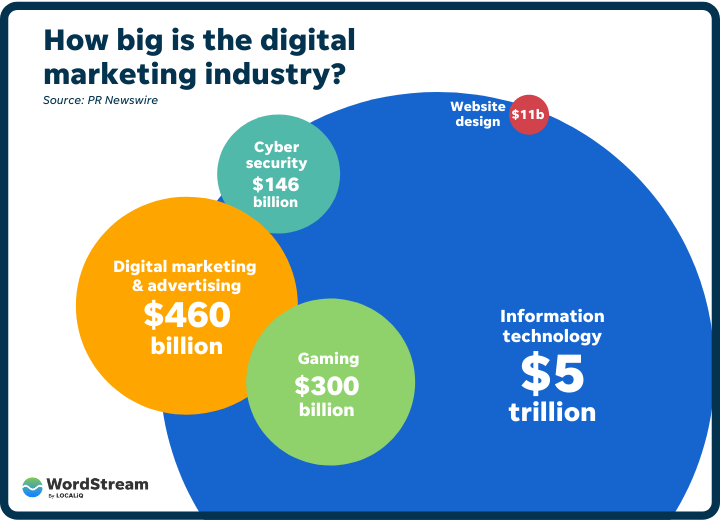

💡 Helpful Statistics About Marketing:

● 82% of companies report using content marketing.

● On average, email marketing has a 4400% ROI. (OptinMonster)

● 76% of content marketers use organic traffic as a key metric for measuring content success. Only 22% use backlinks.

.

● 78% of salespeople using social media perform better than their peers. (Screwpile Communications)

● 98% of sales reps with 5000+ LinkedIn connections meet or surpass sales quotas. (The Sales Benchmark Index)

● There are 1.5 billion social media users across the globe. (McKinsey and Company)

● The purpose of content marketing is to create and share relevant information to attract and engage a target audience that’s interested in

your product or service.

● Blogs with educational content get 52% more organic traffic than blogs with company-focused content.

Table of Contents

What is the capitalization of marketing costs?

Capitalization of marketing costs refers to the practice of treating certain marketing expenses as assets on a company’s balance sheet, rather than as expenses on its income statement. This allows the company to spread the cost of the marketing activity over a longer period of time, rather than taking a one-time hit to its profits. However, not all marketing costs can be capitalized, and there are specific rules and regulations that must be followed in order to do so.

What types of marketing costs can be capitalized?

Generally, only marketing costs that are directly related to the creation or production of a specific asset can be capitalized. This includes costs such as the creation of a new website, the development of a new product brochure, or the production of a television commercial. However, costs related to ongoing marketing activities, such as advertising or promotional events, cannot be capitalized and must be expensed in the period in which they are incurred. It’s important to consult with a qualified accountant or financial advisor to ensure that your company is following the proper rules and regulations regarding capitalization of marketing costs.

How do you determine if a marketing cost can be capitalized?

To determine if a marketing cost can be capitalized, you must first determine if it is directly related to the creation or production of a specific asset. This means that the cost must have a direct and identifiable benefit to the asset, such as increasing its value or extending its useful life. Additionally, the cost must be incurred before the asset is put into service. It’s important to keep detailed records and consult with a qualified accountant or financial advisor to ensure that your company is following the proper rules and regulations regarding capitalization of marketing costs.

What are the benefits of capitalizing marketing costs?

The main benefit of capitalizing marketing costs is that it allows businesses to spread out the cost of the marketing campaign over the useful life of the asset it benefits. This can help to reduce the impact of the cost on the company’s financial statements in the short term. Additionally, capitalizing marketing costs can increase the value of the asset and improve the company’s financial position. However, it’s important to note that not all marketing costs can be capitalized and businesses must follow specific rules and regulations to ensure compliance.

What are the potential risks and drawbacks of capitalizing marketing costs?

While capitalizing marketing costs can have its benefits, there are also potential risks and drawbacks to consider. One risk is that if the marketing campaign does not generate the expected return on investment, the capitalized costs may become a burden on the company’s financial statements. Additionally, capitalizing marketing costs can lead to inflated asset values, which may misrepresent the true financial position of the company. Finally, businesses must ensure they are following the specific rules and regulations for capitalizing marketing costs to avoid any legal or financial consequences.